Think Ahead. Don't Let

Day-To-Day

Operations Drive Out Planning

Financial

Our financial planning process is a thorough, yet simple way for you to take the first step toward reaching your financial goals. Throughout our process, we can help develop customized financial strategies that can turn your goals into reality.

- We identify the values and beliefs most important to you and your family.

- We establish a clear set of short & long-term financial goals based on your values & beliefs.

- Together, with your tax, legal and other professional advisors, we compare financial alternatives and develop recommendations that work towards achieving your financial goals.

A well rounded financial plan examines your total financial picture: your current financial position, risk management, investment planning, retirement planning, tax planning, and estate planning. Your most valuable asset is time. The sooner you begin to plan for your financial future, the better your chances of achieving your goals.

Some of our Financial Services include the following, but not limited to:

- Annuities

- Asset Protection

- Charitable Giving

- College Planning

- College Funding

- Estate Planning

- Fixed Indexed Annuities

- Guaranteed Income

- IRA & 401(K) Assets and Planning

- IRA, 401(K) and 403(B) Rollovers

- Lifetime Income Planning

- Retirement Income Planning

- Safe Money Options

- Social Security

Schedule Your Appointment To See What We Can Do For You!

Schedule Your Appointment with

John Barada, ChFC, RFC, CCPS

Today!

The 4 True Wealth Killers

Why isn’t the average American family winning the wealth game? It truly seems as if everyone is making money off of your money – except you. As I was growing up, I was asked if I wanted $1 million today or a penny that doubles every day for 30 days. Of course, the $1 million sounded great until I did a little math! In 30 days, that penny becomes $5.3 million! So, these four killers are based on that scenario, having $5.3 million at a time in the future!

- 1) You cannot win without compound interest. Warren Buffet said, “The man who understands compound interest will earn it, those who don’t will pay it.” Every financial person I’ve ever met believes that compound interest is fundamental to growing wealth. So…why are we so fast to interrupt or stop that compounding? Every time our compounding account loses value, we interrupt the compounding interest, every time we allow someone else to control that account, we interrupt the compounding interest. This will always have a huge impact on our bottom line, especially over a long time, like for retirement for example. In our $1 million or penny example above, what would happen if on days 5, 15, and 25, our balance didn’t grow? We didn’t lose any money; it just didn’t grow. Our $5.3 mill drops to $670,000 (rounded). Still a good sum of money, but certainly not $5.3 million.

- 2) Easily, the largest wealth transfer you will ever experience is taxes. You already know this, and you have ever since you received your first paycheck and you learned the word, “net”. The traditional/ conventional answer to this has been “tax deferral”. I mean, who doesn’t want to “not pay taxes now” and push them down the road until you’re in a lower tax bracket? Almost makes you sound stupid for even considering it, correct? Of course, we now have a problem, what will the tax rate be when I decide to use this money? The answer, you don’t know. I don’t know, nobody knows! There is ample evidence that taxes can only go up in the future but that is another discussion. Instead of the word deferral, let’s use “postpone”. We simply postponed our taxes until a later date. The real issue is that we also postponed our tax calculation to an unknown amount. Do you really want your future tax bill to be at the mercy of Washington, D.C.? If you deferred taxes, it is! So, let’s assume that you find a way to remain in the 15% tax bracket. Even then, your $5.3 million becomes just over $559,000. Again, not a bad sum of money, but not even in the same zip code as $5.3 million.

- 3) In spite of the legislation to make fees more visible to investors, a long list of fees will continue to reduce your share of the balance of accounts. You still cannot even find some of them listed. Then to pour salt into the wound, the fees are still taken out even if the market crashes and even after you retire. What happens if the market crashes after you retire? You lose money but your advisor still gets paid. Really? These fees usually run 1-3% per year so a 2% fee will reduce your balance to $2.9 million. A very respectable sum, but your advisor made nearly as much as you at $2.4 million. He didn’t put up any of the money, take any of the risks, or work an entire life just to have a retirement account to take almost half of the money? What if he takes 3%?

The real-world scenario of this example is that no one ever only experiences just one of these factors in isolation of the others, but a combination of all three at the same time. If we combine the 3 days of not growing our money, a 15% tax bracket, and a 2% fee on our $5.3 million, we get an extremely disappointing $51,000. Less than 1% of your expected balance. Good luck trying to make retirement work out on that amount of money.

You’ve spent 30+ years doing what you’ve been told, thinking you are doing the right thing, yet at the end of those years you have very little money and now must depend on Social Security for income. You’ve run out of time, with no time left to change it and you will run out of money. Welcome to average America! This is exactly where many people are at today.

- 4) Just in case I haven’t depressed you enough, the fourth and final wealth killer is the hardest to hear, to learn, and to accomplish. The first three will have aspects that we can minimize but not totally eliminate. The fourth, however, is total within our control.

The fourth is paying cash! There, I said it, now you can throw this report in the trash or hang around to understand why I could possibly say that. Paying cash is a great strategy to get the best price on most anything, and I’m all for that. But why give up compounding and control to save a little, or even a lot of money?

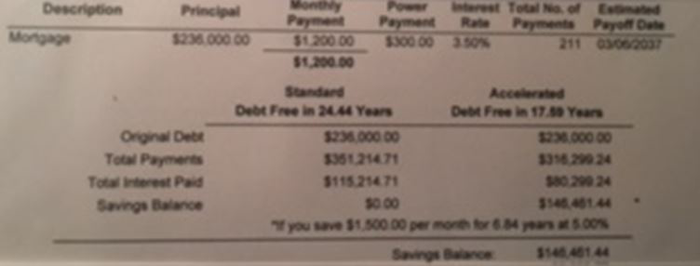

An example of one of my clients illustrates this perfectly! This family was debt-free with the exception of their mortgage! By paying off their mortgage early they avoided paying $35,000 of interest to the mortgage company. A healthy amount that improves nearly every budget for sure. But at what cost? You see, if they simply paid it off to save $35,000 but also forfeited compound interest and control of their money, they also forfeited over $146,000 it would be worth at the end of the original mortgage period. Save $35k to forfeit $146k, doesn’t sound like a good financial move, yet nobody asks the question, “At what cost?”. What if we could do BOTH! Save the $35,000 on the mortgage interest and still have the $146,000 in the account to use as we please? You can, just like this client, and we can show you how.

Schedule your appointment to see what we can do for you!

Phone (314) 488-3180

Your Wealth Must Reside Somewhere!

Your wealth must reside somewhere! It must have a permanent place of residence. You must own, control, and have use your money, or you haven’t built any wealth, you just stashed some money away. About 90 % of Americans keep their wealth in either taxable, unavailable, and/or volatile residences that limit what you can do with their money. If what you thought was true about your money, wasn’t true about your money, when would you want to know? I first heard this question from Don Blanton, a fine southern gentleman with a distinct southern Georgia drawl, and I’ve been unable to “unhear” it, since.