Planning and Paying For

COLLEGE

With Confidence and Ease

What Stage Are You?

The Actions You Take Now To Prepare For College Depends On What Stage Your Child Is In.

Click Your Stage Below To See What Project Steps To Take

EARLY STAGE

Your child is in Early Stage from birth through elementary school.

MIDDLE SCHOOL

Your child is in Middle School Stage from 6th grade through 8th grade.

HIGH SCHOOL

Your child is in the High School Stage when in 9th or 10th grade.

LATE STAGE

Your child is in the Late Stage when in 11th or 12th grade, or already in college.

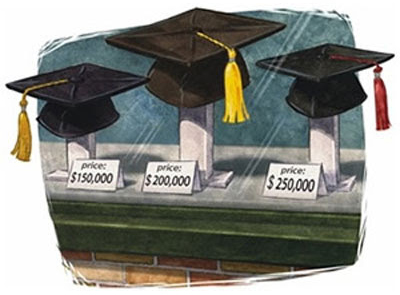

College has become one of the most expensive, stressful, and anxious times most parents and students alike will face. But it doesn’t have to be that way.

Just as you guided your son or daughter through all that life has offered to this point, we are here for you as you continue the quest to ensure they have a college experience that provides the greatest opportunity with the least financial and emotional sacrifice.

History

College Planning Consultants, LLC shows you how to take control of your own cash flows, preserve your wealth, reduce taxes to minimums, and recoup the interest you currently pay to others. We use time-tested strategies to grow wealth safely and predictably for generations to come. We challenge the status-quo so you can win financially.

Get in touch

I know that finding the right financial advice is a choice not to be taken lightly. That’s why I offer free consultations to walk you through your needs, the scope of your goals, and your budget.

Today, a family can exceed $250,000 in college costs – for one child!

You should expect more than simplistic one-size-fits-all savings strategies from a financial advisor. With our firm, you can expect more and we will deliver more!

- Are we candidates for financial aid?

- How much financial aid can we expect?

- How much in scholarships/grants?

- Can we increase our financial aid eligibility?

- What merit-based scholarships, at selected schools, is our child eligible for and what are the eligibility requirements?

- Are 529 college savings plans the right choice?

- And many more!

Thank you for taking a few minutes to fill out my college planning factfinder. It may end up saving you significant amounts of money on your out-of-pocket college costs!

When you are ready to proceed, please click on the link below.

Meet John Barada, ChFC, RFC, CCPS

PRESIDENT / COLLEGE PLANNING CONSULTANTS, LLC

John Barada III is the President and Managing Member of CPC LLC. As a long time financial industry veteran, John routinely worked with families. Over the last ten years, John found himself working more and more frequently with parents that were facing two challenges: sending kids to college and planning for retirement. Many parents are concerned that funding their children’s college will impact their future retirement date.

As a Certified College Planning Consultant, and a Financial Advisor, John and his team guides parents and students through FAFSA, college profiles and admissions requirements. All of which take into consideration John’s extensive knowledge of finances, investments and insurance accounts and how to properly use them. […]

People often struggle with excess debt and taxes. We (at PWG) create a personalized get out of debt game plan while at the same time, building your wealth, safely and predictably. This allows our clients to live the lifestyle they’ve dreamed of with total peace of mind.

Want a personalized report? Your free personalized report will answer vitally important questions that every parent with a college-bound student MUST know

What Clients Are Saying

Educational Workshops

Gain Financial Intelligence. Attend an educational workshop.

Services Offered

College Planning Consultants, LLC specializes in these Financial & Insurance products.

We’d love to hear from you!

College Planning Consultants, LLC shows you how to take control of your own cash flows, preserve your wealth, reduce taxes to minimums, and recoup the interest you currently pay to others. We use time-tested strategies to grow wealth safely and predictably for generations to come. We challenge the status-quo so you can win financially.

Please give us your contact information and we’ll be happy to reach out to you.

Ask us any questions you may have, and we’ll be sure to help answer them.

Phone (314) 488-3180

Your Wealth Must Reside Somewhere!

Your wealth must reside somewhere! It must have a permanent place of residence. You must own, control, and have use your money, or you haven’t built any wealth, you just stashed some money away. About 90 % of Americans keep their wealth in either taxable, unavailable, and/or volatile residences that limit what you can do with their money. If what you thought was true about your money, wasn’t true about your money, when would you want to know? I first heard this question from Don Blanton, a fine southern gentleman with a distinct southern Georgia drawl, and I’ve been unable to “unhear” it, since.